How to enable instant withdrawals (Part I: processing)

Date: Apr 12, 2024

This blog post was a collaboration between Sporttrade and Push Cash.

Enabling Instant withdrawals is moving from “nice to have” to “need to have.” Instant withdrawals not only help you increase customer loyalty, they can actually help you reduce your overall payment costs. This article is intended to provide an overview of key questions you need to answer to enable instant withdrawals and the data points to help you make those decisions.

Why do I need to enable instant withdrawals?

Consumers have overwhelmingly said that they want instant withdrawals for gaming. Sporttrade has witnessed this first hand. In fact:

-

75% of bettors said that receiving payouts quickly is the most important factor when deciding to open an account with an online sportsbook (paysafe)

-

79% of of bettors would opt for instant withdrawals when provided the option (pymnts)

However, many consumers feel that they don’t have access to instant withdrawals. According to a pymnt’s study, Just 49% of gamers have access to real-time disbursements.

Will instant payments increase my payment costs?

While it sounds counter-intuitive, enabling instant withdrawals can actually reduce your total cost of payments by decreasing your deposit to withdrawal ratios.

How? Historically, consumers have come to expect that it will take 2–3 days for a withdrawal to process. Because of this, many consumers pre-emptively cash-out to ensure that they have access to their funds when they need them.

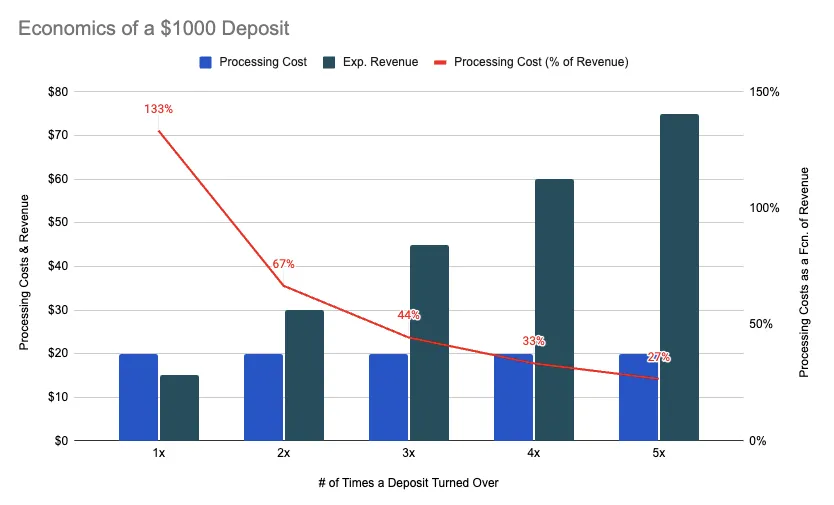

However, when consumers know that they can get their money out instantly, 24/7/365, they feel more comfortable keeping their funds on a platform. Below is an illustrative chart that indicates when money is left on a platform longer, an operator like Sporttrade can achieve greater margins from lower payment velocity assuming a 2% processing cost per transaction.

For a company like Sporttrade where their source of revenue is 2% commission on a winning transaction, these fees can add up very quickly for a customer with high payment velocity.

So while you, the operator, end up paying a slightly higher fee for an individual’s instant withdrawal (vs. traditional ACH credit), you may actually see your overall costs come down over time as you reduce the need for the number of deposit transactions (for the same handle). You may also realize other unexpected savings in things like customer service volume.

What do I need to do to set up instant payments?

There are three, high-level questions to answer before enabling instant payments.

-

How do I pick an instant payment processor?

-

How do I set up automatic, instant decisioning for withdrawals?

-

What do I need to communicate to my customers?

1. How do I pick an instant bank transfer solution for withdrawals?

TL;DR: We recommend choosing a bank transfer solution based on its performance across deposits AND withdrawals. Push Cash performs exceptionally well across both deposits and withdrawals.

Until earlier this year, there were only two types of instant bank transfer solutions; ACH/Real Time Payments (RTP) centric providers (e.g. Trustly) or debit card centric providers (e.g. Fiserv). Now there is a third option — Push Cash! Launching this year, Push Cash is the first of its kind, multi-network instant bank transfer provider.

Traditionally, Operators chose a bank transfer solution based on its performance on deposits. The challenge with picking a bank transfer solution type based on deposits only, is that these different bank transfer solutions differ significantly on their performance for withdrawals.

-

Traditional bank transfer solutions (e.g. Trustly) cover 65% of consumer accounts with instant withdrawals: Traditional bank transfer providers rely on the Fednow and “The Clearing House (TCH)’s” “Real-Time-Payment (RTP)” networks. These two networks are almost identical, in that they both use push-style, instant payments. Their biggest challenge is that RTP only covers 65% of US accounts. Given the high degree of financial institution fragmentation in the US, and the fact that all of the top banks have already enabled RTP — getting from 65% to 90% may take years given the long tail of banks that will need to turn it on.

-

Traditional card processors (e.g. WorldPay) can cover 99% of consumer accounts with instant withdrawals: Many of the top card processors support “Original Credit Transfers” (OCT). These providers utilize a consumer debit card number (PAN) to “push” funds over Visa Direct and Mastercard Send networks to the consumers’ checking account. Visa and Mastercard have done a great job of driving account coverage, in fact close to 99% of consumer bank accounts are set up to receive OCTs. While pricing will vary by provider, generally operators will find the cost of RTP vs. OCT is fairly comparable. It’s important to note that while debit card processing has higher instant withdrawal coverage, card processing solutions often see higher fraud management costs and lower transaction limits on deposits.

-

Push Cash supports instant withdrawals to close to 100% of consumer checking accounts: Because of our unique multi-network approach, Push Cash has the ability to push (no pun intended) withdrawals across both OCT and “real-time-payment” networks. This gives us the ability to reach ~99% of consumer accounts. Importantly, as discussed in our blog post on authorization rates, our multi-network approach lets us spike on both deposit performance and instant withdrawal coverage.

One final thought: While it might be tempting to mix processors across deposits and withdrawals to match Push Cash’s performance, this approach will open up serious fraud vectors. The issue with this approach is that you can not tie a bank account between card and ACH processors. Mixing processors could create the opportunity to deposit funds from one bank account and withdraw them to a different bank account.

2. How do I set up automatic, instant decisioning for withdrawals?

TL;DR: Integrating with a processor for instant withdrawals is a critical, but you can not go live without a compliance program and processes to automatically review and monitor transactions.

There are three critical components you will need to have in place (in addition to an instant bank transfer processor) to launch.

There are three critical components you will need to have in place (in addition to an instant bank transfer processor) to launch.

While this is a baseline requirement for any operator, it is critical from a risk perspective that any consumer you have brought on board has been fully “KYC’d” and screened (incl. PEP, OFAC, adverse media). While there are many vendors that provide these services, look for a provider with strong user dashboards, customization, and control.

Framework for real time transaction monitoring

For each individual withdrawal, you should have a framework in place to evaluate its relative risk. The overall goal is to automatically approve as many transactions as possible, while stopping any and all bad actors. Many will use the “green,” “yellow,” “red” approach to categorize transactions based on their perceived level of suspiciousness.

-

Red: These are transactions flagged as high risk. They typically trigger pre-defined rules that indicate a high probability of money laundering, terrorist financing, or other illegal activity. Example rules include flagging transfers to high-risk countries or transactions involving sanctioned entities. With red transactions, you should expect to decline the transaction, investigate it, and likely report it to the appropriate party. (This scenario may also require additional action to the patron profile such as suspension.)

-

Yellow: These are transactions categorized as medium risk. They might not necessarily violate specific rules but raise some concerns due to unusual patterns or deviations from customer behavior. Examples include sudden minimal gaming in a continuous pattern, withdrawals to a different account (then used for deposits), abnormal velocity, or frequent transfers to unknown beneficiaries. Yellow flags warrant further investigation to determine if they are legitimate or require escalation.

-

Green: These are transactions deemed low risk. They typically fall within expected customer behavior and don’t trigger any red flags. You should expect to automatically approve all “green” transactions for instant withdrawals.

Real time transaction monitoring (build or buy)

Your framework (previous section) should help you build the ruleset you utilize with your transaction monitoring software. Transaction monitoring analyzes patterns in customer behavior and transactions. By setting rules and monitoring for red flags like large or unusual transactions, geographically inconsistent activity, or transactions with sanctioned entities, it can highlight areas that might require further investigation.

Whether you build (or buy) a transaction monitoring solution, its output should trigger a specific action (e.g. decline, approve, or further review). In the case of approval, it should trigger an automatic and instant withdrawal!

3. What do I need to communicate to my customers?

TL;DR: Consumers have been asking for Instant withdrawals, it’s time to crow a little bit! However, it’s also very important to manage expectations, particularly with certain instant bank transfer solutions that don’t support all users.

Your launch strategy and consumer messaging will be particular to your brand, but we suggest that it at least include the following elements:

Make sure to let your users know!

You have done the work to implement instant withdrawals and you are giving them what they have been asking for. The following can help spread the word to your users:

-

Consumer email: Tell your consumers that instant payments are now available. Be specific around which payment option to use, how to use it, and any limitations around use (for example you have to use that payment option to deposit, in order to use it to withdraw).

-

Blog post: Depending on how your users engage with your platform, one option is to write a blog post on why you have (now) decided to offer instant payments. This blog post could include how to use it and an overview of the user experience.

-

Highlight it in your cashier: We recommend highlighting in your cashier that the particular option offers instant withdrawals.

Manage expectations

Reminder, different types of “instant bank transfer” solutions have different levels of performance. If you choose a traditional bank transfer provider, and promise instant withdrawals to all users, you may frustrate 35% of users. In this case, we recommend that you communicate with your users how to check to see if instant payments are supported.

New User experiences to communicate payment timing

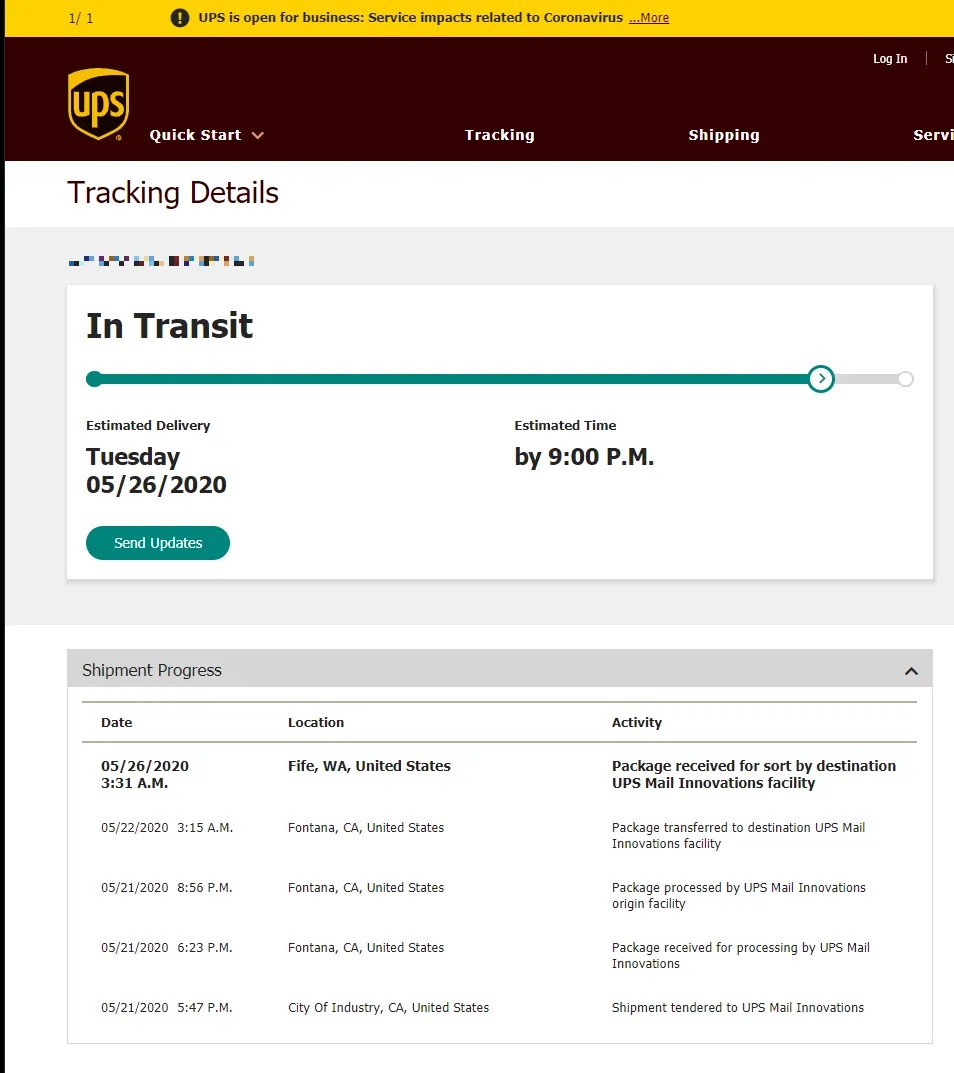

Given you now have certainty, around when the payment will land, you can now show the state of the transaction. You can show when it was submitted, what’s happening (e.g. instant review), and transmission. Clearing communicating timing can help you build trust with your consumers. You could even create a UPS style tracker for withdrawals.

In closing

Instant withdrawals are here, we are excited about them. If you have any questions, or want to talk more please reach out (hello@pushcash.com)!