Payments and Player Lifetime Value

Date: Jul 10, 2024

Part 1

The margins in online sports betting can be razor thin for operators. Even market leaders like DraftKings are not immune to these challenges, in fact DraftKings saw -11% operating margin (Yahoo! Finance) last quarter. One of an operator’s biggest costs is marketing to drive acquisition and retention. Often their second biggest cost is payments.

Given the high costs to attract and retain customers, maximizing customer lifetime value (“LTV”) should be priority #1. The path to higher LTV is via increased conversion and retention rates. Given the high cost of marketing and payments, this series of blog posts will focus on how to use these levers to drive LTV.

Push Cash can help operators increase player conversion and retention, and uniquely help make offers and loyalty program spend more efficient. Over the next couple of weeks, we are releasing a 4 part deep dive on player lifetime value:

-

Part 1: Payments and Player Lifetime Value

-

Part 2: Utilizing offers to maximize retention (and how Push helps make it more economically efficient)

-

Part 3: Using payments to increase customer conversion and retention

-

Part 4: The case for customer loyalty programs (and how Push can help you retain your best customers)

Why should I care about player lifetime value?

It can be very expensive to acquire customers (read: Customer Acquisition Cost, “CAC”). Top Sports Books will spend $500M — $600M on marketing and promotions. Players have become accustomed to rich signup promotions; Scaleo estimates operators’ average Cost Per Acquisition (CPA) ranges in the $250 to $750 range.

However, According to Gaming America, “On average, only 52% of bettors make more than two deposits, and only 4% are loyal to a platform for longer than a year.” Poor retention leads to poor returns on your Customer Acquisition Cost. Increasing Player Lifetime Value is critical.

Scaleo estimates the LTV for an average online sportsbook user ranges from $1,200 to $1,800 over a period of 2–3 years.

What are the drivers to increase player LTV?

Given the importance of LTV, let’s take a second to hone in on what drives life-time-value.

Customer LTV = Average Customer Value per year × Average Customer Lifespan

At the highest level, there are four drivers to increase player LTV.

Increase average customer value via:

-

Increase average wager size

-

Increase number of wagers per year

-

Increase player use of higher theoretical hold products (e.g. parlays)

Increase Average Customer Life Span via:

- Increase number of years player is active on platform

How do Marketing and Payments impact player LTV?

Given the high costs of marketing and payments, we will focus on how they can positively (or negatively) impact customer LTV. Before getting into how these drivers can impact LTV, it’s important to define what we mean:

-

Payments: The different cash-in / cash -out options presented to a player in the operators cashier

-

Offers: Promotional offers used to drive specific action (e.g. $20 match bonus on $20 wager)

-

Loyalty Programs: Ongoing programs designed to reward specific behaviors, as players accumulate more points their rewards increase (e.g. VIP status players receive invites to exclusive events)

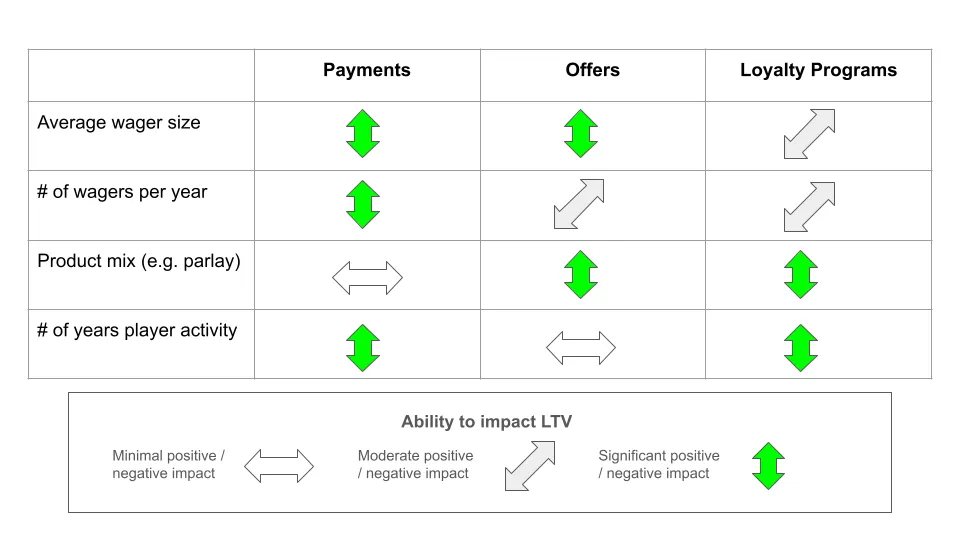

Over the next 3 blog posts we will dive deeper into how payments, offers and loyalty programs can positively or negatively impact player LTV. But at a high level:

-

Payments: Done well, Payments increase average wager size by supporting higher deposit limits. Payments providers with high authorization rates can increase the number of wagers per year by minimizing declines. And long term, providing player access to their money via instant transfers can increase # of years of player activity. However, payments done wrong can push away customers by limiting deposits, declining transactions, and restricting access to funds.

-

Offers: Offers can be highly effective at driving a one time increase in wager size AND usage of high margin products, however in the long run they can be cost inefficient due to their limited ability to drive on-going behavior.

-

Loyalty Programs: Unlike offers which can have a direct impact on behavior, loyalty programs reward positive player behavior over time. A well designed loyalty program can increase wager size, number of wagers, and number of years of activity — however realizing these results often can take much longer (vs. offers).

How can Push help me increase player lifetime value?

Push Cash can deliver industry leading authorization rates, helping you maximize player conversion and retention (read: don’t lose players due to translation declines). Importantly Push supports higher dollar value transactions, increasing wager size. And Push provides instant withdrawals to all users, providing greater user control over their funds (increasing long term retention).

Perhaps one of the most interesting features about Push is the ability to help you make your offers and loyalty programs better.

The most important thing you can do is to give the right promotion to the right player. This is the case whether you employ an offers strategy or loyalty program strategy (or both). Worst case scenario is offering $50 to any player who completes a single action (e.g. wagers once). This strategy creates deal hunters, and equally rewards deal hunters vs. true high LTV players. Additionally the value of a $50 incentive will vary player by player; for some players it may not be enough to drive desired behavior whereas for others you may have overpaid.

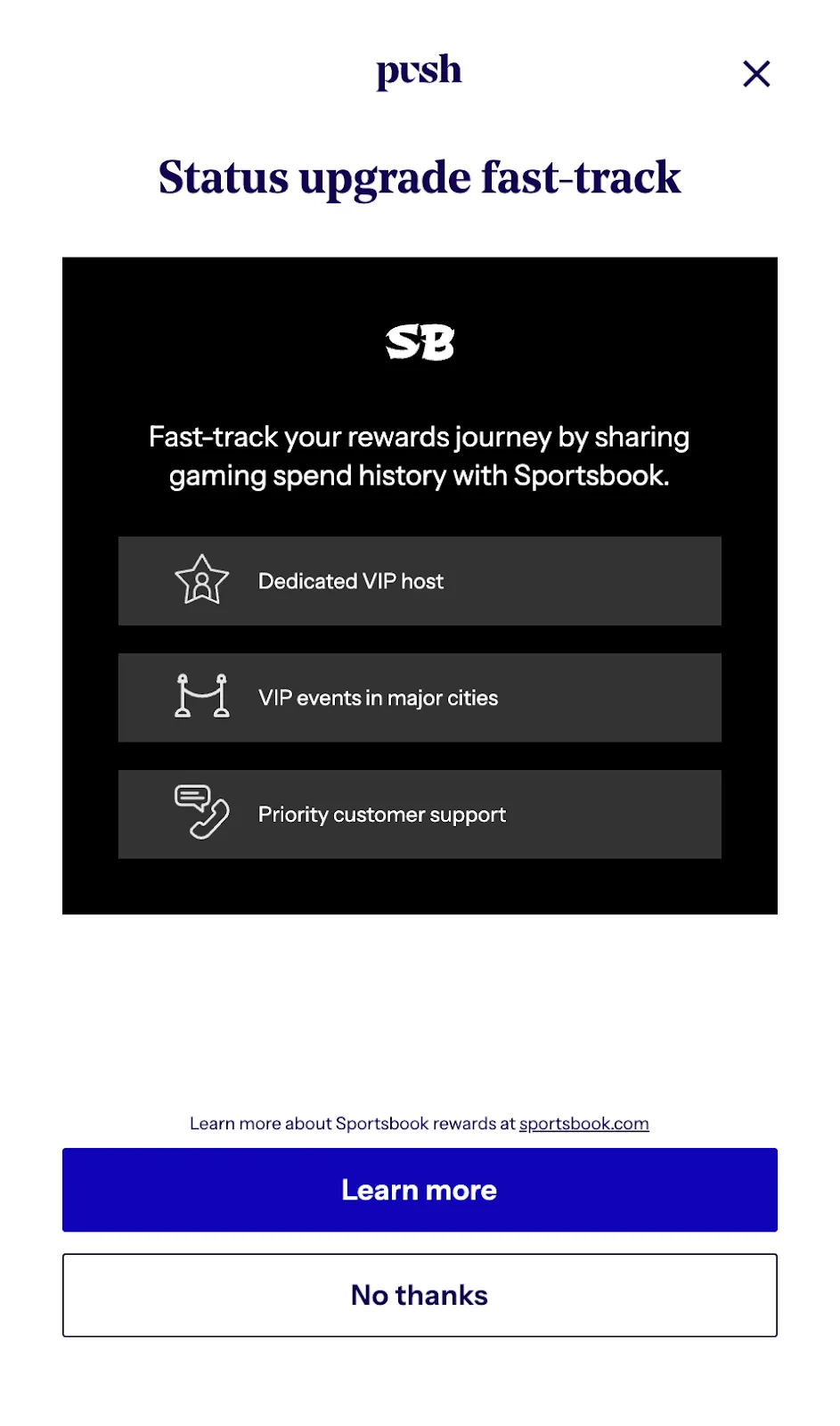

Push Cash can help with this. Push Loyalty is a feature of the Push’s Payment Platform that uses banking integrations to identify historical gaming spend on a per user basis. Push enables Players to share aggregated gaming spend with Operators. Operators can use this information to create targeted offers for players, driving behavior from high value players. Additionally, if you have a rewards program with multiple tiers, you can use this information to place them into the correct tier from the first time they play with you — offering them richer rewards and creating deeper loyalty from the start.

Coming soon: Utilizing offers to maximize retention

In the next installment, we will focus on offers. Specifically, when is the right time to use offers to drive retention? What are examples of great programs? What are the core components of a great program? And how can Push make your offers program better

— — — — — — — — — END PART 1 — — — — — — — — —