The Real Cost of Payment Processing

Date: Jun 6, 2025

When making a purchasing decision, whether it be a consumer buying a car or a business making a software choice, the decisionmaker always will weigh the value of the product against how much it costs. In some cases, pricing is simple - it’s the sticker price. But oftentimes pricing is more complicated due to additional unknown fees or costs associated with using the service.

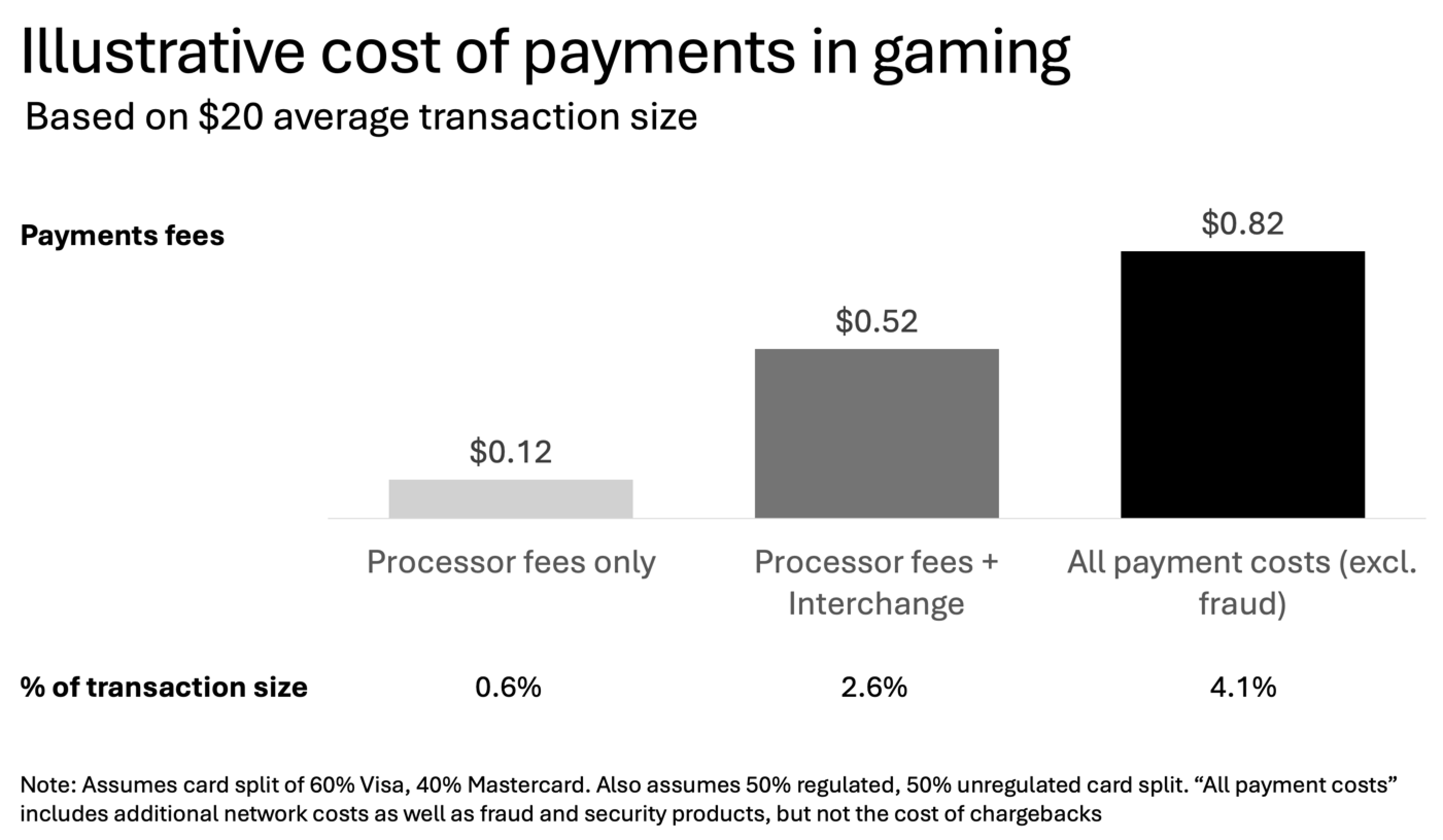

Such is the case for payments processing. The cost of payments includes interchange, other network fees, processor fees, security costs, and the cost of fraud, most of which are not known up front. Push Cash prides itself on offering transparent, guaranteed pricing, with no exceptions.

In this blog post, we share some examples of unknown payment costs and what they may end up costing you.

Apples to Apples Comparisons

Many businesses think they’re comparing apples to apples in payment costs when they look at processor fees, or even processor fees and interchange, but that’s just the beginning. Push’s research has shown us many additional fees charged by the networks, some of which are shared here, but we encourage you to take a look at your next month’s processor statement to see exactly what you are paying.

The Extra Layer: fees you may not know about

When people think about network fees - they think interchange. That’s often the bulk of fees, but it varies based on the mix of regulated and unregulated cards that your consumers use (interchange for unregulated cards in gaming is 165 bps for MasterCard and 185 bps for Visa, while regulated cards are only 5 bps). In addition to the ad valorem (bps), networks also charge an interchange fixed fee per transaction, ~$0.20.

However, both Mastercard and Visa also include additional pass through fees, some of which are vertical or “merchant category code” specific. Altogether, these fees can add an additional ~$0.10 and ~20 bps to the average transaction cost.

Some examples include:

- Visa Debit Transaction Integrity Fee - $0.10 per transaction. Transactions under gaming merchant category codes are considered high risk and not applicable for Custom Payment Services (CPS) qualifications, and are subject to this additional fee.

- Visa fixed acquirer network fee (FANF) - tiered fee based on volume, ranges between 2-8 bps of total volume.

- MasterCard Network Access-Brand Usage (NABU) Fee - $0.0195 per transaction

- MasterCard Assessment Fee - 13-14 bps

Outside of network fees, you will likely pay processor fees for enabling you to accept cards (e.g., $0.10 + 10 bps per transaction). However, in addition to those fees, you may be paying up to $0.15 per transaction depending on the fraud, tokenization, and security products you use.

If you’re interested in seeing our full research into network and processor fees, please email us at hello@pushcash.com.

Chargebacks

Even beyond these hard costs charged by the networks and processors, merchants must be prepared for chargebacks, which can add 50+ bps to your cost of payments. In a later installment, we will deep dive into chargebacks and their potential impact on your business.

The Push Promise: Guaranteed Debit, No Exceptions

At Push Cash, we offer a guaranteed price, zero additional costs, and no exceptions to our guarantee. We take the guessing and risk out of payments for you, and our rates are transparent and better than non-guaranteed card products.

If you’re interested, and want to hear more about how we do it, please reach out to us at hello@pushcash.com. Thanks!