What makes a great cashier?

Date: Feb 21, 2024

For Operators and Fintechs, the cashier is a foundational component of a great user experience. Building a great Cashier takes time, and there’s a lot of decisions to make. This is the first entry of an on-going discussion around how to think through some of the decisions you will need to make as you build your cashier.

Cashier 101

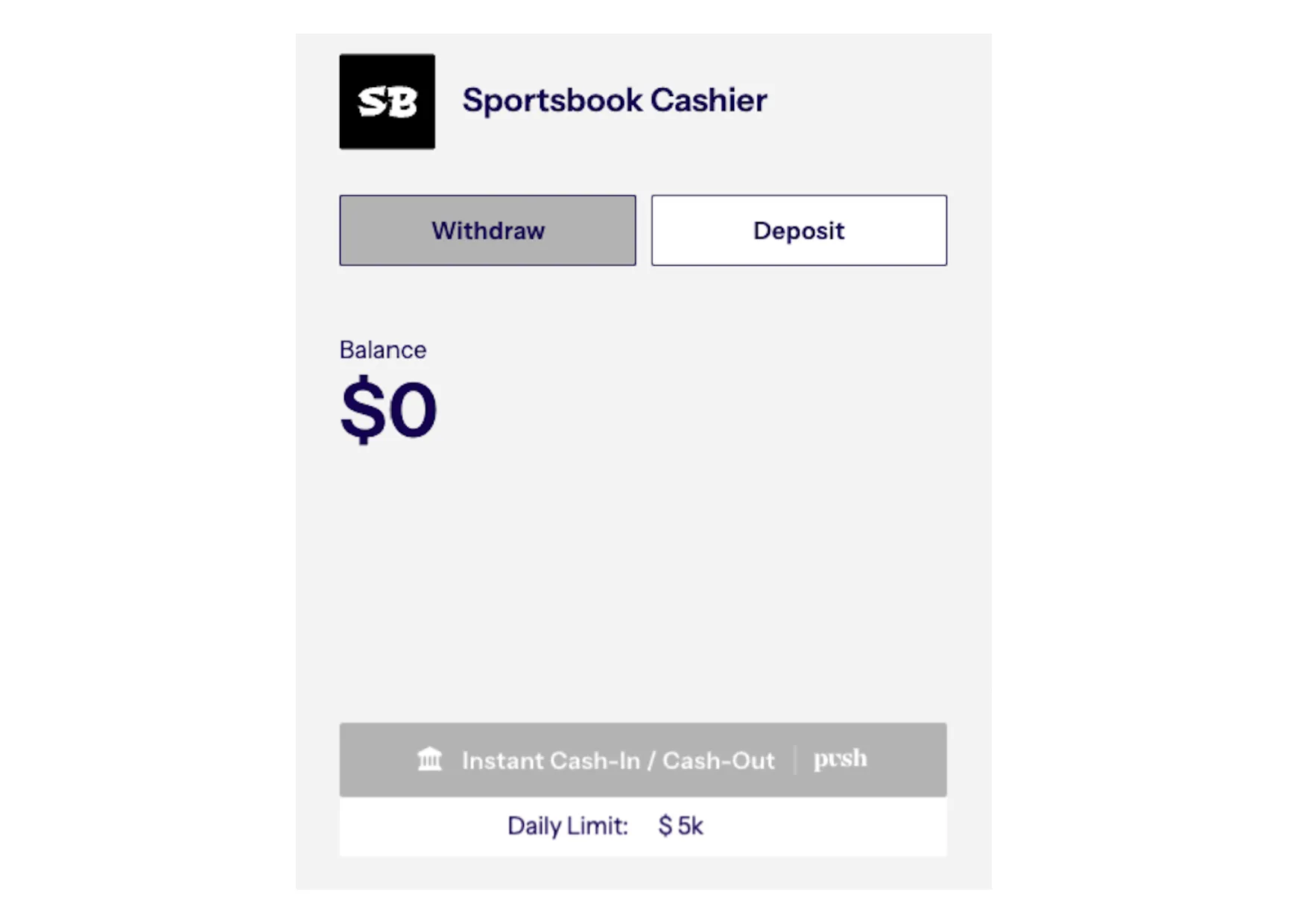

Before we get started, it’s important to level-set on “what is a cashier.” The Cashier facilitates transactions between a customer and a business and displays up-to-date account balances. A well designed cashier minimizes users’ money movement questions. It clearly communicates limits, processing times, and provide access to detailed transaction history.

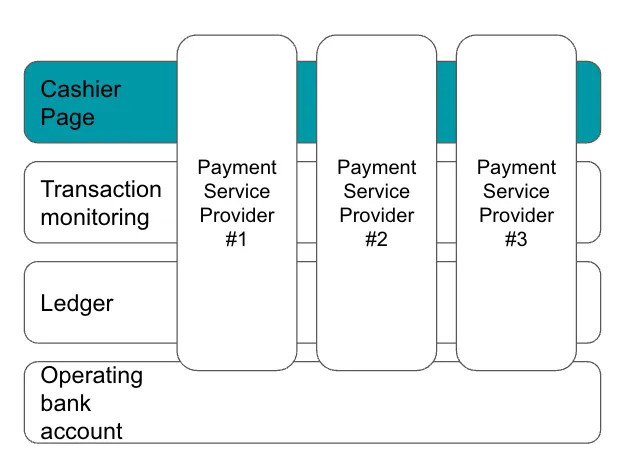

The cashier is composed of both a front end (what the user interacts with) and a back end that integrates with key services within the operator’s stack. The cashier integrates with the operator’s ledger, payment service providers, and transaction monitoring services.

Cashier 201

A strong cashier can strengthen a user’s bond with the platform, while a poor cashier can lead not only to lost revenue but also to lost customers. Building a great cashier is not easy, and there are a number of very important decisions to make. This post (and following posts) is designed to arm you with the information and data points needed to make those decisions:

-

Which payment service providers do I want to use for deposits? (focus for today)

-

Which payment options do I want to support for withdrawals?

-

What role do loyalty programs play in the cashier?

-

Do I integrate with different payment service providers directly or use a gateway?

-

How do I create a compliant, effective, but fast transaction monitoring service?

-

How do I architect it to make it as simple as possible to integrate the cashier with core systems (e.g. data warehouse, ledger, support)?

TL;DR: How to optimize deposit payment options

Bank Transfers should be the cornerstone of any cashier, as they maximize users’ purchasing power by pulling funds directly from their checking account (>80% consumers’ core store of value). The challenge with Legacy Bank Transfer PSPs is that they require the operator make performance trade-offs. Push Cash delivers bank transfers without compromise, allowing Operator’s to optimize user purchasing power, authorization rates, transaction limits, and conversion.

Additionally, we also recommend Operators support Digital Wallets (e.g. PayPal) as they tend to be complementary funding sources to bank transfers. For Daily Fantasy Sweepstakes operators (only), we also recommend offering credit card acceptance as it can tap additional funds and allow users to earn points.

How to evaluate PSPs for deposits

You have spent significant time and effort to acquire users. To retain and grow them you need to implement Payment Service Providers (PSPs) that maximize a user’s access to available funds and payment success rates. When evaluating any PSP, we recommend asking the following questions:

Does the PSP maximize a user’s access to their available funds?

-

What funding source does the PSP pull from?

-

Does the PSP limits constrain customer transactions?

Does the PSP’s authentication and authorization processes maximize payment success?

-

Can users complete a transaction with information immediately on-hand?

-

Will the PSP approve all good transactions?

Can the PSP’s pull from users’ largest source of funds?

Bank Transfers maximize users’ access to their available funds. An overwhelming percentage of Americans store the majority of their transactional funds in their checking account. Providing users easy access to this account is the first step towards maximizing open to buy. It should be noted too, that for some use cases (e.g. Daily Fantasy) alternative PSPs like credit card processors and digital wallets can provide access to incremental funding, further increasing open to buy.

-

US bank account: 81.5% of US households have a bank account (FDIC). Generally most users want to pull money from and deposit money directly back to their bank account. The average checking account balance is $16.9k. For most Americans, the checking account is the largest store of transactional funds.

-

Credit Cards: 77% of US Adults have a credit card, and the average credit card limit is $28.9k. However, depending on the operator’s vertical, the consumer may be charged a 5% (or more) cash-advance fee for using it, making this a lower priority option for most consumers (Federal Reserve).

-

PayPal / Venmo: Est. 56% of Americans have a PayPal account (demandsage). Some users like the ability to use a separate account for specific purposes. However, users generally don’t keep as much cash in their digital wallet; the avg. balance in PayPal account is $485 (Logica).

-

Gaming specific digital wallets: <1% of US adults have gaming specific digital wallets (Sightline).

Push Cash allows users to pull funds directly from their preferred checking account.

Do transaction limits align with customer expectations?

Different PSPs will impose different transaction limits.

-

Debit Card processors: Most debit cards carry $2.5k — $5k daily limits. Chase for example has a $5–7.5k daily transaction limit (Forbes)

-

Credit Card processors: Most issuers will limit cash advance amounts as percentage of total limit. For example, Chase limits cash advance to 30% of total limit (Chase)

-

Guaranteed ACH providers: Guaranteed ACH providers typically support up to $10k daily limits for most users.

-

Wires: Wires are virtually uncapped by banking networks, however issuers and originators may enforce caps.

-

Digital wallets: Often limited only by balance available in wallet (which is usually lower than checking account balance).

Push Cash can support up to $100k daily transaction limits.

Can users complete transactions with information on-hand?

As you think about which payment service provider to implement, it’s important to consider what payment instruments (e.g. enter card details vs. bank username/PW) they require. To maximize conversion, the PSP needs to ask for information the user has immediately on hand. While using digital wallets may feel “fast” — most Americans don’t have an Apple Pay account. However almost all Americans carry a debit card and have memorized the login and password.

-

Enter Card details (e.g. payment gateway): 90% of adults carry a debit card in their wallet (Buzzfeed)

-

Bank login (e.g. Trustly): 78% of adults prefer digital banking, meaning 78% likely remember their login and password (Forbes)

-

Wallet specific login (e.g. PayPal): 58% of US adults are current users of PayPal (Logica)

-

The “Pays” (e.g. Android Pay): The “pays” can be highly efficient for people that have it, but only 21% of US population (>14 years) have Apple Pay (Capital One)

-

Account and routing (e.g. VIP preferred): Very few Americans have memorized their checking account account and routing numbers. Only 21% of Americans carry a checkbook (onovative)

Push Cash’s UX asks for user’s debit card and bank login, information almost all users have on hand.

Will the PSP decline good transactions?

The last thing that you want is for a good transaction to be declined because of suspected fraud. Legacy PSPs specialize in a specific payment network (e.g. card vs. ACH vs. digital wallet), each carrying different authorization rates:

-

Digital wallets (e.g. PayPal): Digital wallets see >90% authorization rates.

-

Credit / Debit Cards (e.g. Card processors): Depending on the “merchant category code,” debit cards can see ~90% authorization rates. (EPX).

-

Guaranteed ACH: Guaranteed ACH providers deliver 65–70% authorization rates.

-

Wires: Wires have near 100% authorization rates, however the user experience can limit conversion (plus they are unavailable over the weekend).

Push Cash’s multi-network approach lets us achieve 90% authorization rates AND guarantee the transfer.

If you are interested in learning more about Push Cash, and what we are building please reach out to us at hello@pushcash.com.