Loyalty: The case for player retention

Date: August 15th, 2024

Part 3

In the last post, we covered how using targeted activation and retention strategies can increase player Lifetime Value (LTV) versus generic offers.

TL;DR: Generic offers can attract “bonus hunters”, while not enticing high value players. Instead, targeting offers can lead to larger lift in high value player transactions.

In this installment, we will focus on using loyalty programs to increase LTV and player profitability. Implementing a simple loyalty program can be a highly cost efficient way to retain players and drive profitable behavior. As discussed in the “Payments and Players and Lifetime Value” post, rewards programs are an economical way to reward repeat, desired behavior.

Loyalty programs provide real value to players, while providing minimal value to “bonus hunters.” Loyalty programs can decrease your promotional spend, because you are only funding actual, repeat players.

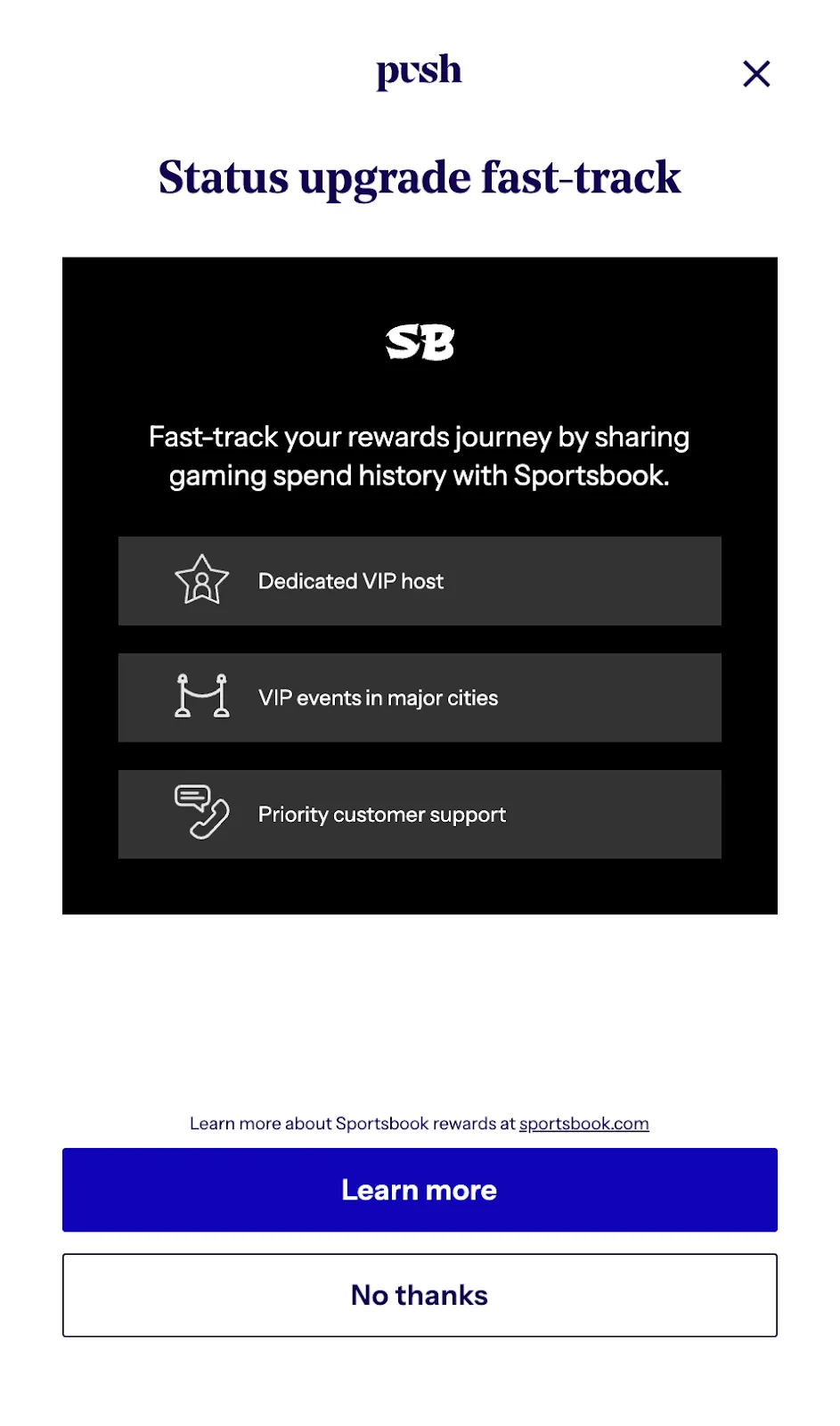

One of the only downsides to a loyalty program is that it can take time for players to accrue benefits (e.g. reaching the highest tiers of the program). Push Cash’s unique loyalty feature lets you identify high value players from their first transaction with you, so that you can slot them into the right rewards program from the start — and help secure their ongoing loyalty.

In this post, we will cover:

-

When is the right time to use loyalty to drive retention?

-

How should I think about designing a loyalty program?

-

How can Push Cash help?

-

Food for thought: examples of innovative programs from other industries

When is the right time to use loyalty to drive retention?

As soon as possible. Customer retention and increasing player LTV is critical, and loyalty programs are the most direct path towards achieving these goals. However, to many operators, it may seem daunting to develop a loyalty program.

While it is true, developing and running a “Starbucks” or “United Airlines” style program can be incredibly costly — there are much simpler programs you can put in place quickly and cheaply. Examples of this include “punch card” type programs around usage as well as “paid membership programs.” As your business grows you can always add more bells and whistles to your program, but getting the program in place early can help build a solid and loyal player base.

How should I think about designing a loyalty program?

Loyalty programs, broadly, keep existing players engaged and returning. But the beauty of utilizing loyalty programs (vs. offers campaigns) is that you can design them to achieve specific outcomes (in addition to retention).

-

Define program objectives: Building player engagement is foundational. The question is to answer though, is how to use it:

- Cross-sell: Encourage players to try other products or services, like parlays or real-time wagers.

- Up-sell: Encourage players to exclusively use your platform (vs. multiple operators) by offering more rewards based on cumulative number or value of wagers placed

- Cost Reduction: Reduce costs of serving players. For example, payments may be one of your biggest costs. You can encourage players to leave money on your platform by offering rewards for maintaining a minimum balance.

-

Customer segmentation: Which players are you trying to retain and grow? Which player behaviors are you trying to change? Once you have identified your target player set, and their current behaviors, you can start to think about designing a program to best serve them.

-

Define your program budget (realistically): Loyalty programs can be expensive, from setup costs (e.g. rewards platform, integration, design), operational costs (player support, program administration), and the actual cost of the rewards or prizes. Planning and budgeting is crucial to ensure the loyalty program is right sized for the stage of your business and delivers a positive return on investment (ROI).

-

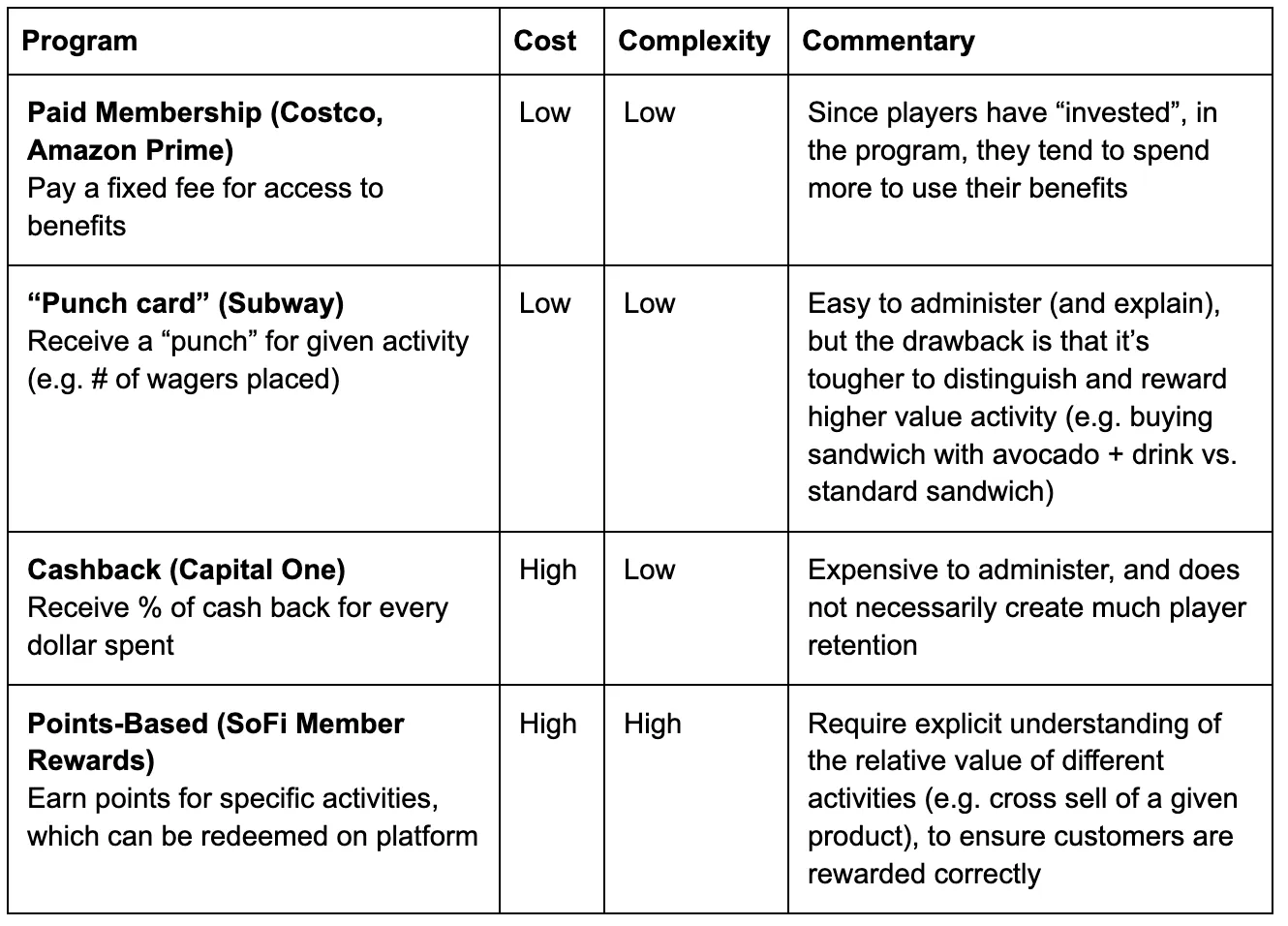

Choose the type of program based on your desired outcomes (and budget): There are four broad types of loyalty programs. We have ranked them below in increasing order of cost and complexity of launch and administration.

-

Decide on rewards structure: Generally, the easier it is to understand the value proposition of the program, the more effective it will be. Keep it simple, “by participating in this program you get <XXX>.” Examples of this are Amazon Prime’s “get 2-day delivery on everything” or Subway’s “buy 5 sandwiches, get the 6th free.” It’s important to think through rewards that players value and that encourage repeat activity on your platform, and for which the value to the operator is higher than the cost of the reward . For example, the perceived customer value of a free cup of Starbucks coffee ($3) is much higher than the cost to make it. Examples of this for operators could include Boosted Odds, Parlay Insurance, and Higher limits

-

Test and learn: You should track progress towards the defined objectives of your program. If the program is not delivering on the desired outcome, you should be ready to tweak the program and try out new offers.

How can Push make my loyalty program more effective and efficient?

Oftentimes, the reason high value players are reluctant to switch platforms is that they don’t want to take the time to establish themselves with a new operator.

Push Cash can help you identify high value players in their first interaction with you. Push’s unique loyalty feature lets players opt-in to share with you their historical gaming spend. You can use this information to place high value players immediately into richer rewards tiers. With Push, these players can “cut the line” — and start seeing real value by moving their play to you.

Food for thought: examples of innovative programs from other industries

In other, highly competitive industries, industry leaders have developed excellent rewards programs which build retention AND drive highly profitable behavior. For example, Starbucks’ program helps them reduce their payment costs, Amazon’s program helps them capture a greater share of wallet, and SoFi’s program helps them cross-sell higher value products. While their specific program may not be applicable to your business, their overall approach and strategy can provide inspiration.

Starbucks Rewards (points based, focus on reducing payments costs)

The Starbucks Rewards program is designed to reward players for their purchases and encourage repeat business. Starbucks was looking to solve for decreasing their payment costs (by encouraging one $25 load vs. five $5 loads) and increasing repeat player usage.

It has seen strong player adoption partly because they can offer players rewards that are perceived at high value, but cost little to offer. For example, offering a cup of coffee will be perceived as a ~$3 value to the consumer, but may only cost Starbucks <$1 to make. Program details:

-

Signup: Customers can join the Starbucks Rewards program for free by signing up through the Starbucks app or website. Members link their Starbucks card or credit/debit card to their account for easy payment and rewards tracking.

-

Earning "stars": Members earn Stars for every purchase made at Starbucks stores. Starbucks offers periodic promotions and challenges for specific purchases or behaviors.

-

Redeeming stars: Members can redeem their Stars for various in-store Starbuck items (e.g. Coffee, sandwiches, etc.).

-

Rewards tiers: The offer green and gold tiers, each of which provides special access to unique products and services

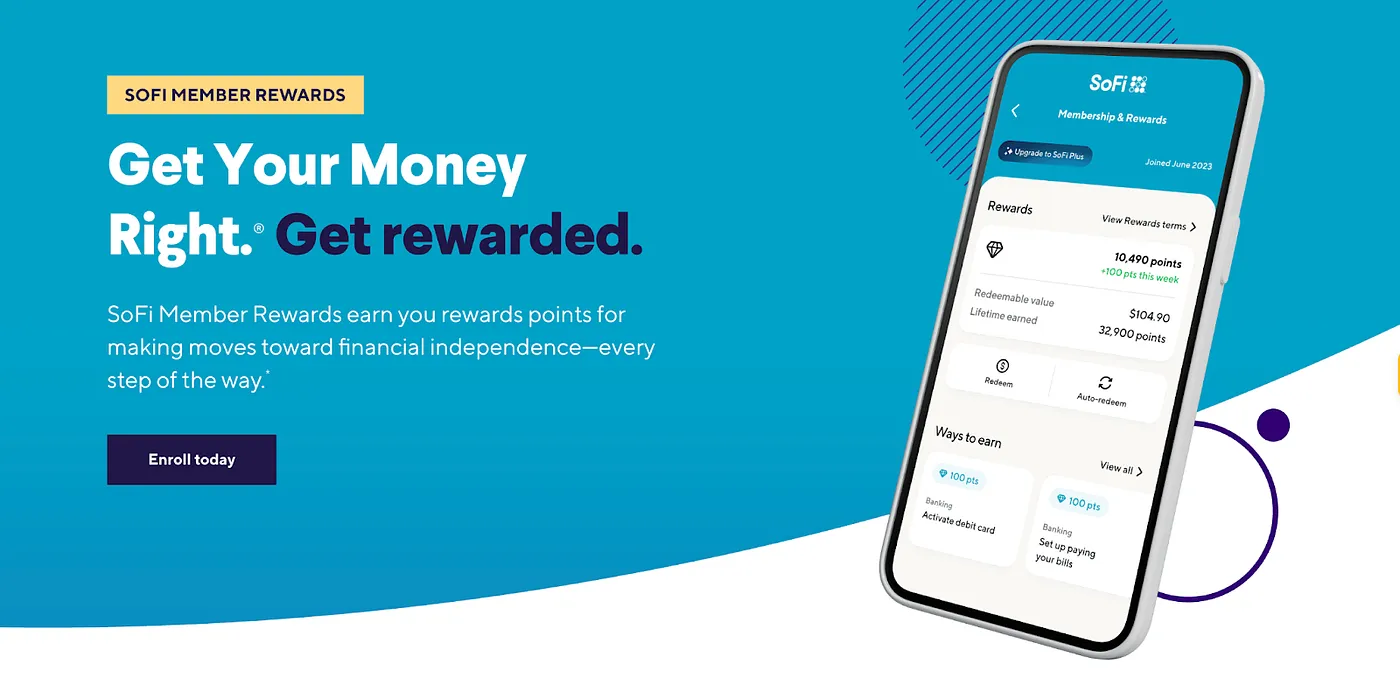

SoFi Member Rewards (points based, focused on cross-sell)

The SoFi rewards program seems designed to help cross-sell consumers financial services. It provides rewards for specific behaviors that increase player profitability (e.g. on-time payments, utilization of higher margin trading accounts). Similar to Starbucks, they offer rewards on products where the perceived value to the player may be higher (e.g. savings on loan) relative to the value SoFi is seeing from the behavior (reduced loan delinquency). Program details:

-

Signup: Members are automatically enrolled in the rewards program upon signing up for a SoFi account.

-

Earning Points: Members earn points for a variety of actions including: Setting up direct deposits, Using SoFi’s financial products such as loans, investments, and insurance, Making payments and transactions with SoFi Money or SoFi Credit Card and referring friends and family who join SoFi and use its services.

-

Redeeming points: Members can redeem points for various rewards, including getting cash to be deposited into SoFi Money accounts, applying points towards SoFi loan payments, investing points into SoFi Invest accounts, and exchanging points for cryptocurrency via SoFi Invest.

Amazon Prime (subscription service, focused on up-sell)

Amazon Prime is a subscription service offered by Amazon that provides members with 2-day — and in some cases 1-day or same-day delivery. Amazon Prime makes it simple to order almost anything, and get it delivered almost immediately. This encourages players to shift almost all ecommerce activity to Amazon, as expedited for other sites can often cost $20 — $30 (and 1 day delivery times are very rare!)

-

Signup: Amazon shoppers create an Amazon account and pay $139 year

-

Utilizing service: Once enrolled, members simply look for “Prime shipping” on Amazon.com. Any purchase they make that is eligible for “Prime shipping” will arrive within 2 days.

Closing thoughts

Thank you for taking the time to read our posts on loyalty. And if you have not yet seen them, please check out our other two posts on loyalty (Lifetime-value and the case for targeted activation and retention strategies and Payments and Player Lifetime Value) as well as general musings on the importance of real time payments.

We do believe that player retention and loyalty is a critical component to profitability. If you have thoughts or feedback, or would like to to learn more about how Push Cash can help please reach out to us at hello@pushcash.com. Thanks!